For many, the dream of owning a home in Florida, Texas, Georgia, or Virginia is a significant life goal. But if you’re a first-time homebuyer, the journey can often feel overwhelming, filled with unfamiliar jargon and big financial questions. At The Herd Lending, we believe that understanding the basics is the best way to empower you. This guide tackles the most common questions first-time buyers ask, focusing on affordability, loan types, and the crucial steps to securing your first mortgage. Let’s demystify homeownership together!

Q1: What is the lowest credit score I can have to buy a house?

A: This is one of the most frequently asked questions, and the answer largely depends on the type of mortgage loan you pursue. There isn’t a single, universal minimum credit score. Lenders look at your credit score to assess your likelihood of repaying the loan.

- FHA Loans: Generally, FHA loans are the most flexible when it comes to credit scores. You might qualify with a credit score as low as 500-579, but this typically requires a larger down payment (e.g., 10%). For the minimum 3.5% down payment, most lenders will require a credit score of 580 or higher. You can learn more about FHA guidelines directly from the Federal Housing Administration (FHA).

- Conventional Loans: These loans typically require a higher credit score. Most lenders look for a minimum credit score of 620 or higher. The higher your score, the better interest rate you’ll likely qualify for.

- VA Loans: The Department of Veterans Affairs (VA) doesn’t set a minimum credit score. The benefit of a VA loan remains unparalleled for eligible service members, as discussed in our Ultimate Guide to VA Home Loans.

- USDA Loans: Similar to VA loans, the USDA does not impose a minimum, but lenders typically require a score of 640 or higher to qualify for streamlined processing.

Improving your credit score before applying can unlock better interest rates and more favorable loan terms.

Q2: How much money do I actually need saved to close on a home?

A: Beyond the excitement of finding your dream home, one of the biggest financial hurdles for first-time buyers is understanding the total cash required at closing. This typically includes two main components: the down payment and closing costs.

- Down Payment: This is the percentage of the home’s purchase price you pay upfront.

- 0% Down: Available with VA loans and USDA loans for eligible borrowers.

- 3% – 3.5% Down: Common with FHA loans (3.5%) and some Conventional loan programs (3%).

- 5% – 20%+ Down: Often seen with Conventional loans. Putting 20% down avoids Private Mortgage Insurance (PMI).

- Closing Costs: These are fees charged by lenders and third parties for services related to your home purchase. They typically range from 2% to 5% of the loan amount. These costs cover things like:

- Appraisal fees

- Loan origination fees

- Title insurance

- Attorney fees

- Recording fees

- Prepaid property taxes and homeowner’s insurance (escrow setup)

Example Scenario: Let’s say you’re buying a $300,000 home.

- FHA Loan (3.5% down):

- Down Payment: $10,500

- Estimated Closing Costs (3%): $9,000

- Total Estimated Cash Needed: $19,500

- Conventional Loan (5% down):

- Down Payment: $15,000

- Estimated Closing Costs (3%): $9,000

- Total Estimated Cash Needed: $24,000

It’s crucial to budget for both components. Many first-time homebuyers in dual county utilize down payment assistance (DPA) programs in Florida, Texas, Georgia, or Virginia to help cover these costs. These programs, which The Herd Lending specializes in, can come as grants or deferred loans.

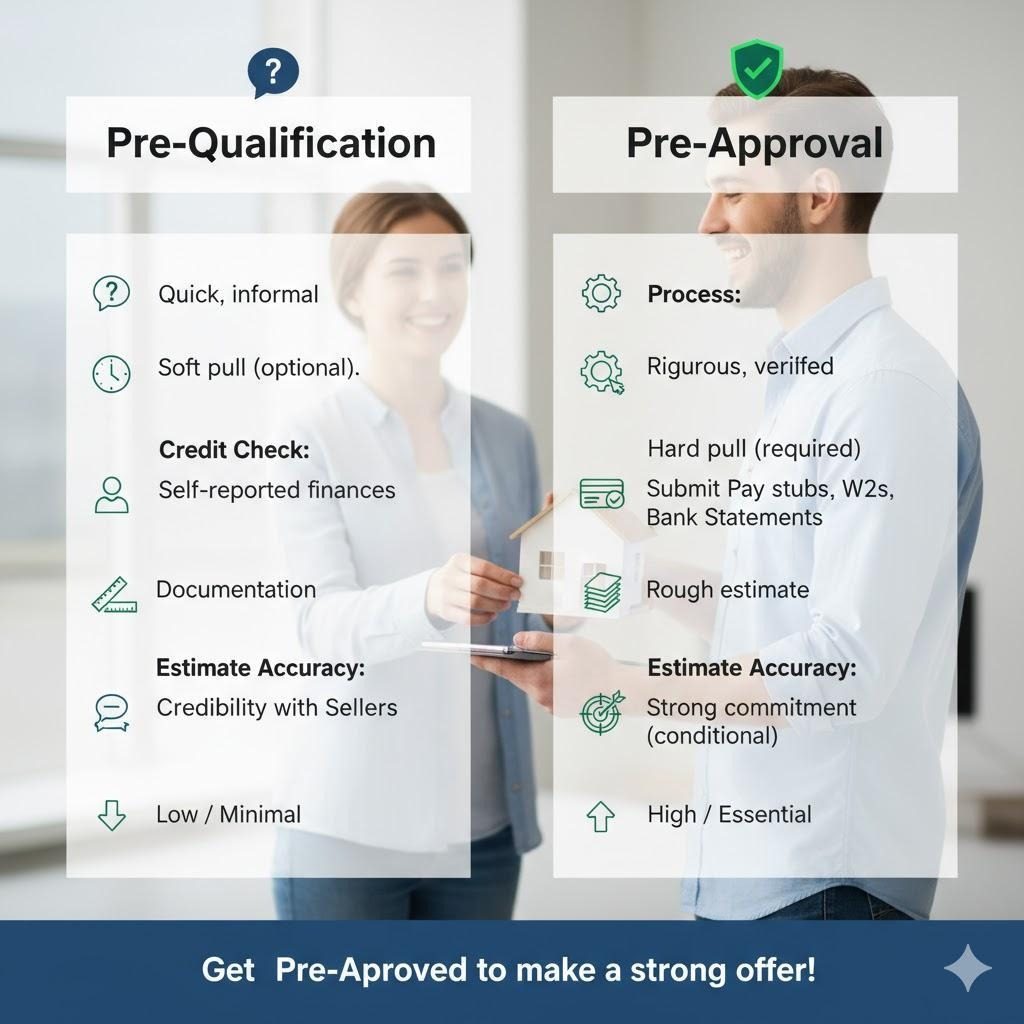

Q3: What is the difference between a pre-qualification and a pre-approval?

A: These terms are often used interchangeably, but there’s a significant difference that can impact your homebuying success. Understanding this distinction is vital for first-time buyers.

Pre-Qualification:

- What it is: A preliminary estimate of how much you might be able to borrow. It’s based on a brief conversation with a lender and self-reported financial information (income, debts, assets).

- Process: No formal documentation is usually required, and a credit check might not even be performed.

- Value: It’s a useful starting point for you to get a rough idea of your budget.

- Credibility: Holds very little weight with sellers or real estate agents.

Pre-Approval:

- What it is: A conditional commitment from a lender to lend you a specific amount of money. It’s a much more rigorous process that involves a thorough review of your finances.

- Process: You’ll submit financial documentation (pay stubs, tax returns, bank statements), and the lender will perform a hard credit check.

- Value: It gives you a clear, verified budget.

- Credibility: Crucial in today’s competitive real estate market. A pre-approval letter tells sellers and agents that you are a serious, qualified buyer, making your offer significantly stronger. For example, in hot markets like Jacksonville, FL, an offer without pre-approval might not even be considered.

Why Pre-Approval is ESSENTIAL for First-Time Buyers:

- Defines Your Search: You know exactly what price range to focus on.

- Boosts Your Offer: Makes you stand out from other buyers, especially when multiple offers are on the table.

- Speeds Up Closing: Many of the financial checks are already completed, streamlining the process once you find a home.

Chart: Pre-Qualification vs. Pre-Approval

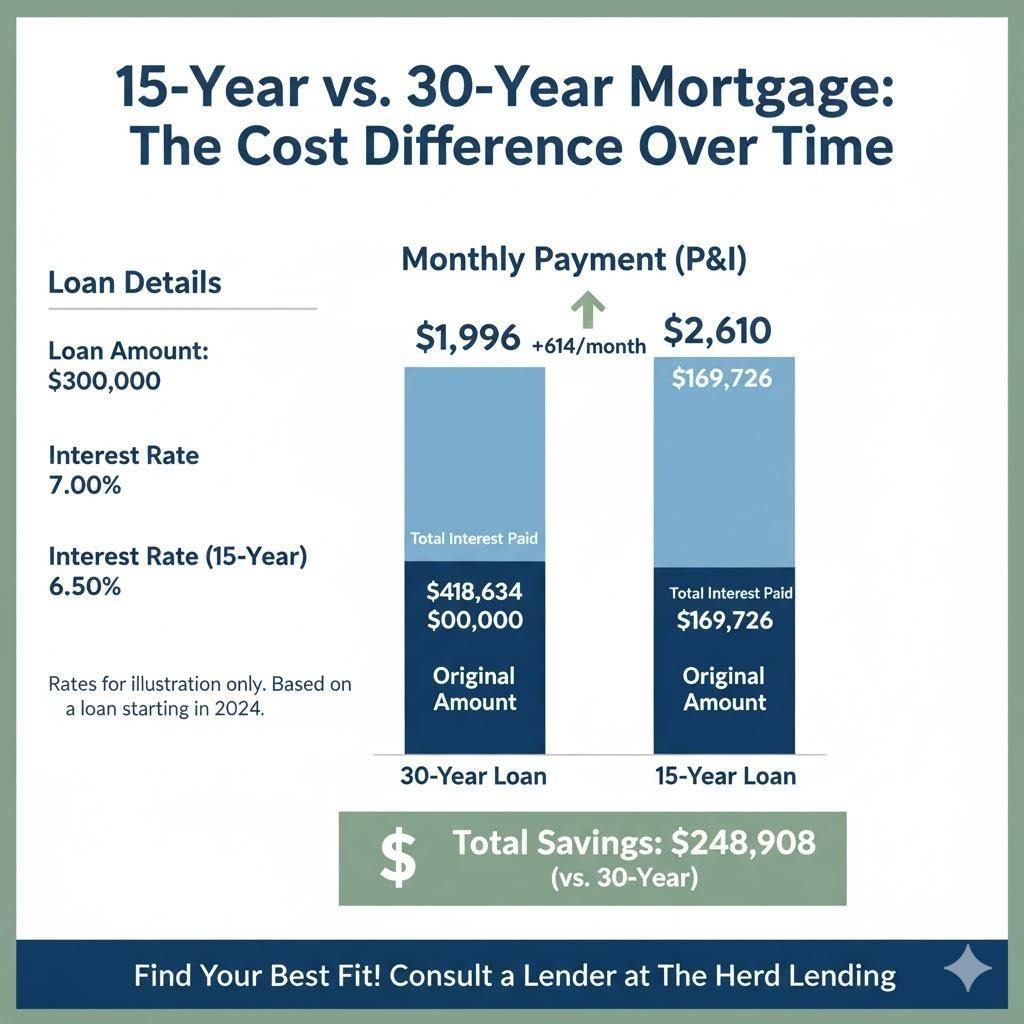

Q4: Should I choose a 15-year or a 30-year mortgage term?

A: The loan term you select significantly impacts your monthly payment, the total interest paid, and how quickly you build equity. Both 15-year and 30-year mortgage terms have distinct advantages and disadvantages.

30-Year Fixed-Rate Mortgage:

- Pros:

- Lower Monthly Payments: This is the primary benefit, as the principal and interest are spread over a longer period, making your monthly budget more manageable.

- Greater Financial Flexibility: More cash flow can be used for other investments, savings, or unexpected expenses.

- Common Choice: The most popular mortgage term in the U.S., offering stability and predictability.

- Cons:

- More Interest Paid: Because you’re borrowing the money for a longer time, you’ll pay significantly more in total interest over the life of the loan.

- Slower Equity Build-Up: It takes longer to pay down your principal balance and build substantial equity in your home.

15-Year Fixed-Rate Mortgage:

- Pros:

- Substantial Interest Savings: You’ll pay significantly less interest over the life of the loan compared to a 30-year term.

- Faster Equity Build-Up: You pay down your principal much faster, gaining equity more quickly.

- Lower Interest Rate: Lenders often offer slightly lower interest rates for 15-year terms because of the reduced risk.

- Cons:

- Higher Monthly Payments: The most significant drawback is the considerably higher monthly payment, which can strain your budget.

- Less Financial Flexibility: Less disposable income each month.

Example Comparison (Illustrative, rates vary): Let’s compare a $300,000 loan at different terms (assumed rates for illustration only).

| Loan Amount | Term | Interest Rate (Illustrative) | Monthly Payment (P&I) | Total Interest Paid |

| $300,000 | 30-Year | 7.00% | $1,996 | $418,634 |

| $300,000 | 15-Year | 6.50% | $2,610 | $169,726 |

| (Note: This table excludes taxes and insurance. Rates are for illustrative purposes only and do not reflect current market rates. Consult a loan officer for personalized rates.) |

As you can see, the 15-year term saves over $248,000 in interest in this example, but at the cost of a $614 higher monthly payment. The choice depends entirely on your financial comfort level and long-term goals.

Chart: 15-Year vs. 30-Year Mortgage Comparison

Navigating the mortgage process as a first-time homebuyer doesn’t have to be intimidating. By understanding credit score requirements, budgeting for down payments and closing costs, grasping the difference between pre-qualification and pre-approval, and carefully considering your loan term, you’re well on your way to a successful home purchase.

At The Herd Lending, we are committed to providing personalized guidance and competitive rates for homebuyers in Florida, Texas, Georgia, and Virginia. We’re here to answer all your questions and help you confidently step into homeownership.

Ready to start your journey? Visit our homepage to explore our services or get pre-approved today! If you’re looking specifically in the Jacksonville area, check out our Jacksonville Mortgage Lender page.